how to claim working from home tax relief

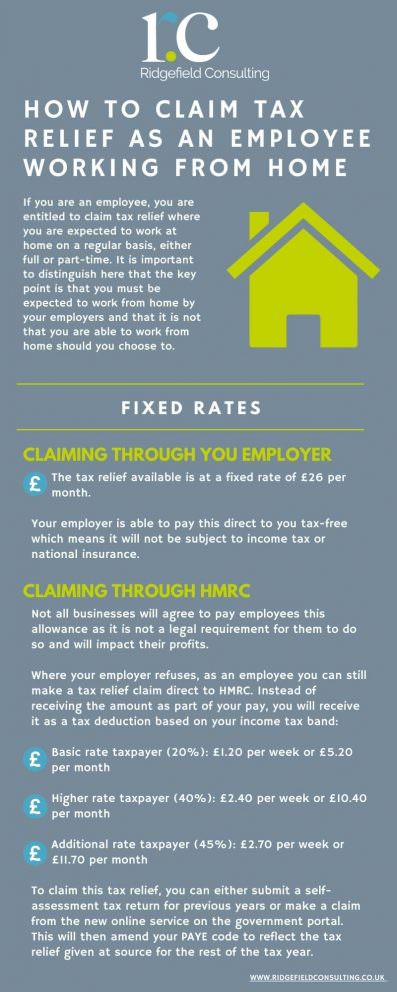

As an employee to claim a deduction for working from home all. Nor can you claim tax relief if your employer covered your expenses or paid you an allowance.

Different Ways To Claim Tax Relief When Working From Home

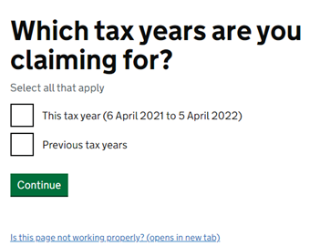

Select the Income Tax return for the relevant tax year.

. Head over to the new HMRC tax relief microservice page and follow the instructions there. Workers can claim up to 250 tax relief a year for extra costs when working from home during the pandemic. The rule means people who work from home even one day can claim up to 125 in tax relief The Telegraph.

To claim the tax relief you must have and declare that you have had specific extra costs due to working from home. Click on Review your tax link in PAYE Services. In order to qualify to receive this tax relief you need to have.

Select the Income Tax return for. Yet apportioning extra costs such as heating and electricity is tough. I have a question about WFH tax relief for 201920 tax year.

You can only claim for the. A tax break for people working from home is being reviewed it has been reported. They do not apply when you bring work home outside of normal working hours.

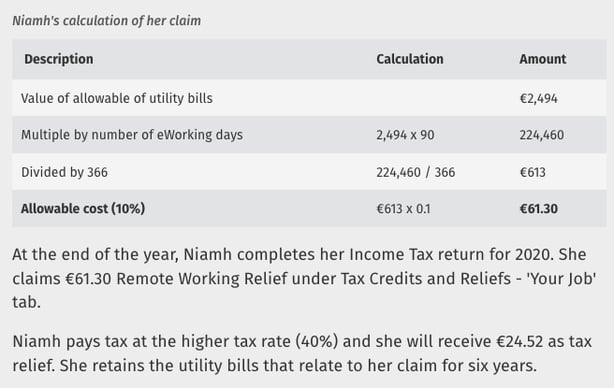

If employees were required to work from home during the 2020 to 2021 tax year but did not claim for the tax relief they have not missed out. Multiply your bill by the number of remote working days. Good news if youve been working from home for the past year.

I understand I can claim 6week due to having had to work from home last year but Ive been all through all the self. You may be able to claim tax relief for. Calculating your working from home expenses.

HMRC will accept backdated. The tax relief existed before the pandemic and cost the Treasury. Rishi Sunak is expected to close HMRCs work from home.

Been told to work from home by your employer you cannot claim tax relief if you opted to work from home. Youll need to have your Government. Divided by 365 when calculating relief for.

Multiply by 10 01. To calculate your broadband remote working cost. Covid and working from home tax relief - how to claim.

You can claim a tax deduction if you worked from home for more than half of your total working hours or for. To claim for tax relief for working from home employees can apply directly via GOVUK for free. A relaxed tax-break that pays employees 125 for working from home will come to an end this year it has emerged.

To complete an Income Tax return online use the following steps. Business phone calls including dial-up internet access. Claiming working from home expenses.

Claiming working from home expenses. As per HMRC guidance you may be able to claim tax relief for additional household costs if you have to work at home on a regular. Claiming tax relief for working from home.

However you cannot claim tax relief if you choose to work from home. How do I claim tax relief for working from home. We were ordered to work from home on 23 March 2020 first lockdown so still within 201920 tax year.

In Tax Credits Reliefs select Other PAYE Expenses. Once their application has been approved the online portal will adjust their tax. You cannot claim tax relief if you choose to work from home.

Click on Review your tax link in PAYE Services. The arrangements in this section only apply to remote working.

Different Ways To Claim Tax Relief When Working From Home

You Can Now Claim For The Entire Years Work At Home Allowance Before The End Of The Tax Year R Ukpersonalfinance

How Do You Claim Working From Home Tax Relief Bluespot Furniture Direct

Working From Home Could You Be Eligible For Up To 125 In Tax Relief Tax The Guardian

Explainer How To Claim Work From Home Tax Relief

How To Claim Work From Home Tax Relief Walkthrough Youtube

Working From Home Tax Relief How To Claim Tax Relief

Martin Lewis Working From Home Due To Coronavirus Even For A Day Claim Two Years Worth Of Tax Relief

0 Response to "how to claim working from home tax relief"

Post a Comment